Compliance automation

Don't get caught out by the FCA

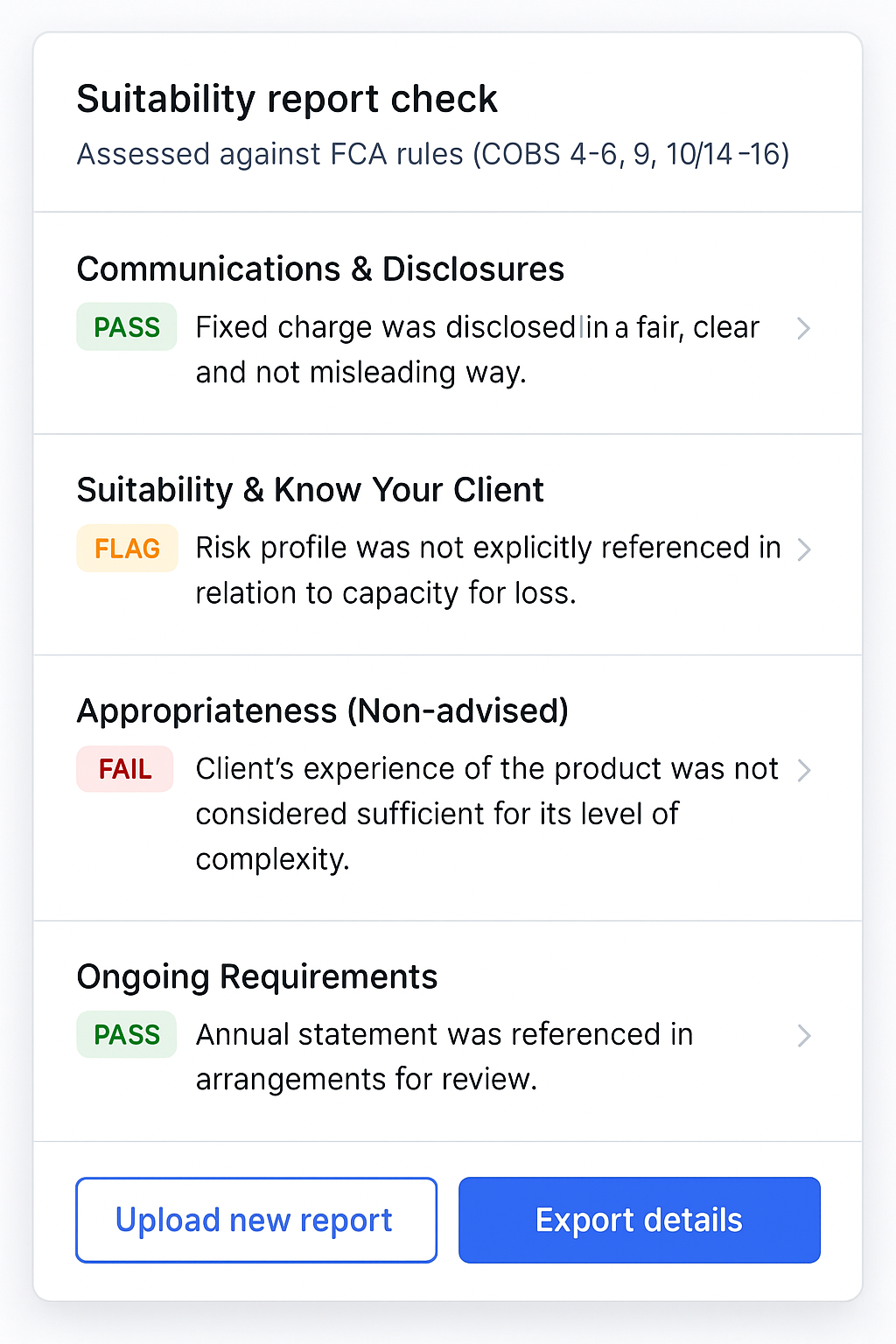

Find and fix suitability gaps before they become findings. Automated checks mapped to FCA rules and your firm policy.

- Checks mapped to FCA rules

- Actionable findings with references

- UK/EU data residency

How it works

Understand the document

Our AI reads your report end‑to‑end using document‑aware language models to extract client facts, recommendations and disclosures.

Map to rules & policy

A policy graph aligns what it finds to FCA SYSC/COBS and your firm rules, checking for gaps, inconsistencies and missing evidence.

Explain & action

Results show PASS/FLAG/FAIL with cited passages and suggested fixes you can drop straight into your report.

Why Assure.ai?

Catch issues early

Spot suitability gaps before they become FCA findings.

Save compliance time

Reduce manual review by up to 80% with automated checks.

Stay FCA‑ready

Continuously aligned with FCA SYSC & COBS, plus your firm policy.

Explainable outputs

Each finding cites the exact passages and policy references.

Secure by default

SSO/MFA, RBAC, encryption at rest & in transit, audit logs.

Configurable retention

Delete data automatically after review, or retain for audit.

What you get

- 10 automated checks

- Findings with references

- One‑click exports

- Email support

Pricing

Frequently asked questions

How does Assure.ai map to FCA requirements?

We align findings to FCA SYSC/COBS and maintain internal mappings that update as regulations evolve.

Where is data processed?

Data is processed in the UK/EU with encryption in transit and at rest. You can configure retention.

What file types can I upload?

PDF and DOCX are supported. We also integrate with common adviser CRMs.